Thursday, January 16, 2025

Sunday, February 13, 2022

LIC Dhan Rekha (Plan No 863)

(A Non-Linked, Non-Participating, Individual, Savings, Life Insurance Plan)

LIC’s Dhan Rekha is a Non-Linked, Non-Participating, Individual, Savings, Life Insurance Plan which offers an attractive combination of protection and savings. This plan provides financial support for the family in case of unfortunate death of the policyholder during the policy term. Periodic payments will also be made on survival of the policyholder at specified durations during the policy term and guaranteed lumpsum payments to the surviving policyholder at the time of maturity. This plan also takes care of liquidity needs through loan facility.

Death Benefit-

Death Benefit payable on death during the policy term after the date of commencement of risk shall be “Sum Assured on Death” along with Accrued Guaranteed Additions.

For Single premium payment, “Sum Assured on Death” is defined as 125% of Basic Sum Assured.

For Limited premium payment, “Sum Assured on Death” is defined as the higher of 125% of Basic Sum Assured or 7 times of annualized premium.

The Death Benefit under Limited Premium payment shall not be less than 105% of total premiums paid excluding any extra premium, any rider premium(s), if any, and taxes as on date of death.

However, in case of minor Life Assured, whose age at entry is below 8 years, on death before the commencement of Risk (as specified in Para 2 below), return of premium(s) paid excluding taxes, any extra amount chargeable under the policy due to underwriting decision and rider premium(s), if any, shall be payable.

Survival Benefit-

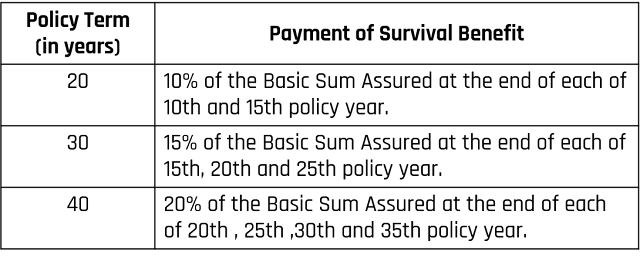

On the life assured surviving to each of the specified duration during the policy term, provided policy is in-force, a fixed percentage of Basic Sum Assured shall be payable. The fixed percentage for various policy terms is as below:

Maturity Benefit-

On Life Assured surviving the stipulated Date of Maturity provided the policy is in-force, “Sum Assured on Maturity” along with accrued Guaranteed Additions, shall be payable. Where “Sum Assured on Maturity” is equal to Basic Sum Assured.

Guaranteed Additions-

Guaranteed Additions shall be payable, provided the policy is in-force by payment of due premiums. The Guaranteed Additions shall accrue at the end of the Policy Year from the 6th Policy Year to the end of the Policy Term. The rate of Guaranteed Additions shall increase in steps with the duration of the policy as specified below:

In case of death under in-force policy, the Guaranteed Addition in the year of death shall be for full policy year.

In case of limited premium policy, if the premiums are not duly paid, the Guaranteed Additions shall cease to accrue under a policy.

In case of a paid-up policy or on surrender of a policy, the Guaranteed Addition for the policy year in which the last premium is received will be added on proportionate basis in proportion to the premium received for that year.

Eligibility Conditions and Other Restrictions-

Date of commencement of risk-

In case, the age at entry of the Life Assured is less than 8 years, the risk under this plan will commence either 2 years from the date of commencement or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately.

Date of vesting -

If the policy is issued on the life of a minor, the policy shall automatically vest on the Life Assured on the policy anniversary coinciding with or immediately following the completion of 18 years of age and shall on such vesting be deemed to be a contract between the Corporation and the Life Assured.

Rider Benefits-

Riders are available under this plan as detailed below on payment of additional premium:

i)- Single Premium Payment:

Under Single Premium Payment, LIC’s Accidental Death and Disability Benefit Rider and LIC’s New Term Assurance Rider shall be available under this plan and the policyholder can opt for these riders at the inception only.

ii)- Limited Premium Payment:

Under limited premium, the following five optional riders shall be available under this plan. However, the policyholder can opt between either of the LIC’s Accidental Death and Disability Benefit Rider or LIC’s Accident Benefit Rider and/or the remaining three riders subject to the eligibility as detailed below.

A)- LIC’s Accidental Death and Disability Benefit Rider:

This rider can be opted for under an in-force policy at any time within the premium paying term of the Base plan provided the outstanding premium paying term of the Base plan as well as the Rider is atleast 5 years but before the policy anniversary on which the age nearer birthday of the life assured is 65 years. If this rider is opted for, in case of accidental death, the Accident Benefit Sum Assured will be payable in lumpsum along with the death benefit under the base plan. In case of accidental disability arising due to accident (within 180 days from the date of accident), an amount equal to the Accident Benefit Sum Assured will be paid in equal monthly instalments spread over 10 years and future premiums for Accident Benefit Sum Assured as well as premiums for the portion of Basic Sum Assured under the Base Policy which is equal to Accident Benefit Sum Assured under the policy, shall be waived. Under the policy on the life of minors, this rider will be available from the policy anniversary following completion of age 18 years on receipt of specific request.

B)- LIC’s Accident Benefit Rider:

This rider can be opted for at any time under an in-force policy within the premium paying term of the Base plan provided the outstanding premium paying term of the Base plan as well as the Rider is atleast 5 years but before the policy anniversary on

which the age nearer birthday of the life assured is 65 years. The benefit cover under this rider shall be available only during the premium paying term. If this rider is opted for, in case of accidental death, the Accident Benefit Sum Assured will be payable in lumpsum along with the death benefit under the base plan.

C)- LIC’s New Term Assurance Rider:

This rider is available at inception of the policy only. The benefit cover under this rider shall be available during the policy term. If this rider is opted for, an amount equal to Term Assurance Rider Sum Assured shall be payable on death of the Life Assured during the policy term.

D)- LIC’s New Critical Illness Benefit Rider:

This rider is available at the inception of the policy only. The cover under this rider shall be available during the policy term. If this rider is opted for, on first diagnosis of any one of the specified 15 Critical Illnesses covered under this rider, the Critical Illness Sum Assured shall be payable.

E)- LIC’s Premium Waiver Benefit Rider:

Under an in-force policy, this rider can be opted for on the life of Proposer of the policy, at any time coinciding with the policy anniversary but within the premium paying term of the Base Policy provided the outstanding premium paying term of the Base Policy and the rider is at least five years. Further, this rider shall be allowed under the policy wherein the Life Assured is Minor at the time of opting this rider. The Rider term shall be outstanding premium paying term of the base plan as on date of opting this rider or (25 minus age of the minor Life Assured at the time of opting this rider), whichever is lower. If the rider term plus proposer’s age is more than 70 years, the rider shall not be allowed.

If this rider is opted for, on death of proposer, payment of premiums in respect of base policy falling due on and after the date of death till the expiry of rider term shall be waived. However, in such case, if the premium paying term of the base policy exceeds the rider term, all the further premiums due under the base policy from the date of expiry of this Premium Waiver Benefit Rider term shall be payable by the Life Assured. On non-payment of such premiums the policy would become paid-up.

The premium for LIC’s Accident Benefit Rider or LIC’s Accidental Death and Disability Benefit Rider and LIC’s New Critical Illness Benefit Rider as applicable shall not exceed 100% of premium under the base plan and the premiums under all other life insurance riders put together shall not exceed 30% of premiums under the base plan.

Each of above Rider Sum Assured cannot exceed the Basic Sum Assured under the Base plan.

For more details on the above riders, refer to the rider brochure or contact LIC’s nearest Branch Office.

No rider shall be available in case of the policies procured through POSP-LI/CPSC-SPV .

Settlement Option (for Maturity Benefit)-

Settlement Option is an option to receive Maturity Benefit in instalments over a period of 5 years instead of lump sum amount under an in-force as well as Paid-up policy. This option can be exercised by the Policyholder during minority of the Life Assured or by the Life Assured aged 18 years and above, for full or part of the maturity proceeds payable under the policy. The amount opted for this option by the Policyholder/ Life Assured (i.e. Net Claim Amount) can be either in absolute value or as a percentage of the total claim proceeds payable.

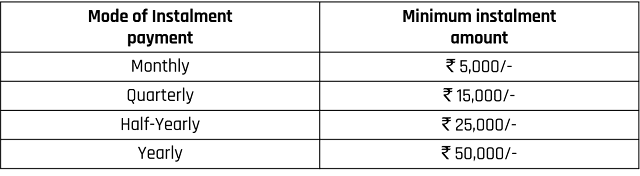

The instalments shall be paid in advance at yearly or half yearly or quarterly or monthly intervals, as opted for, subject to minimum instalment amount for different modes of payments being as under:

If the net claim amount is less than the required amount to provide the minimum instalment amount as per the option exercised by the Policyholder / Life Assured, the claim proceed shall be paid in lump sum only.

For all the instalment payment options commencing during the 12 months’ period from 1st May to 30th April, the interest rate used to arrive at the amount of each instalment shall be annual effective rate not lower than 5 year Semiannual G-Sec rate minus 2%; where, the 5 year G-Sec rate shall be as at last trading day of previous financial year.

Accordingly, for the 12 months period commencing from 1st May, 2021 to 30th April, 2022, the applicable interest rate for the calculation of the instalment amount shall be 3.96% p.a. effective.

For exercising the settlement option against Maturity Benefit, the Policyholder /Life Assured shall be required to exercise option for payment of net claim amount in instalments at least 3 months before the due date of maturity.

The first payment will be made on the date of maturity and thereafter, based on the mode of instalment payment opted for by the policyholder, every month or three months or six months or annually from the date of maturity, as the case may be.

After the commencement of Instalment payments under Settlement Option against Maturity Benefit:

A)- If a Life Assured, who has exercised Settlement Option against Maturity Benefit, desires to withdraw this option and commute the outstanding instalments, the same shall be allowed on receipt of written request from the Life Assured. In such case, the lumpsum amount, which is higher of the following shall be paid and the policy shall terminate.

- discounted value of all the future instalments due; or

- (the original amount for which settlement option was exercised) less (sum of total instalments already paid);

B)- The applicable interest rate that will be used to discount the future instalment payments shall be annual effective rate not exceeding 5 year Semi-annual G-Sec rate; where, the 5 year Semi-annual G-Sec rate shall be as at last trading day of previous financial year during which Settlement Option was commenced.

Accordingly, for the 12 months’ period commencing from 1st May, 2021 to 30th April, 2022 the maximum applicable interest rate used for discounting the future instalments shall be 5.96% p.a. effective.

C)- After the Date of Maturity, in case of death of the Life Assured, who has exercised Settlement Option, the outstanding instalments will continue to be paid to the nominee as per the option exercised by the Life Assured and no alteration whatsoever shall be allowed to be made by the nominee.

Option to take Death Benefit in instalments-

This is an option to receive Death Benefit in instalments over a chosen period of 5 years instead of lump sum amount under an in-force as well as paid-up policy. This option can be exercised by the Policyholder during minority of the Life Assured or by Life Assured aged 18 years and above, during his/her life time; for full or part of the Death benefits payable under the policy. The amount opted by the Policyholder/Life Assured (i.e. Net Claim Amount) can be either in absolute value or as a percentage of the total claim proceeds payable.

The instalments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum instalment amount for different modes of payments being as under:

If the net claim amount is less than the required amount to provide the minimum instalment amount as per the option exercised by the Policyholder /Life Assured, the claim proceed shall be paid in lump sum only.

For all the instalment payment options commencing during the 12 months’ period from 1st May to 30th April, the interest rate used to arrive at the amount of each instalment shall be annual effective rate not lower than the 5 year Semi-annual G-Sec rate minus 2%; where, the 5 year G-Sec rate shall be as at last trading day of previous financial year.

Accordingly, for the 12 months’ period commencing from 1st May, 2021 to 30th April, 2022, the applicable interest rate for the calculation of the instalment amount shall be 3.96% p.a. effective.

For exercising option to take Death Benefit in instalments, the Policyholder during minority of the Life Assured or the Life Assured, if major, can exercise this option during his/her lifetime while in currency of the policy, specifying the period of Instalment payment and net claim amount for which the option is to be exercised. The death claim amount shall then be paid to the nominee as per the option exercised by the Policyholder/Life Assured and no alteration whatsoever shall be allowed to be made by the nominee.

Payment of Premiums-

Premiums can be paid regularly at yearly, half-yearly, quarterly or monthly intervals (monthly premiums through NACH only) or through salary deductions.

Grace Period-

A grace period of 30 days shall be allowed for payment of yearly or half-yearly or quarterly premiums and 15 days for monthly premiums from the date of First Unpaid Premium. During this period, the policy shall be considered in-force with the risk cover without any interruption as per the terms of the policy. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

The above grace period will also apply to rider premiums which are payable along with premium for Base Policy.

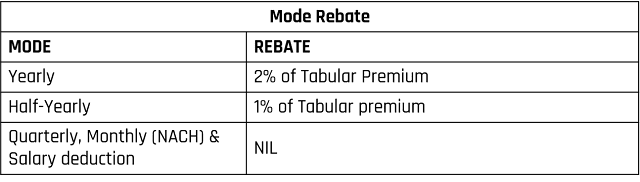

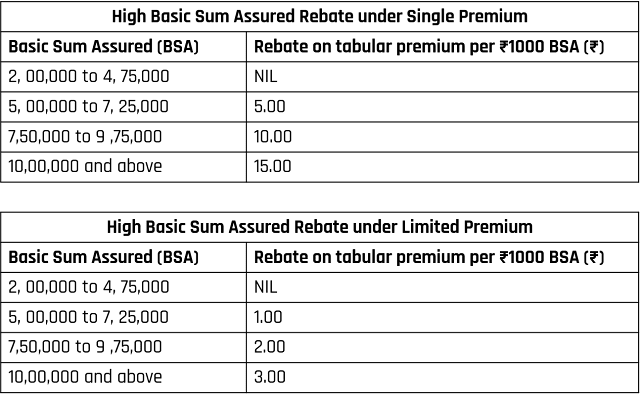

Rebates-

Revival-

If the premiums are not paid within the grace period, then the policy will lapse. A lapsed policy can be revived, but within a period of 5 consecutive years from the date of First Unpaid Premium but before the date of maturity. The revival shall be effected on payment of all the arrears of premium(s) together with interest (compounding half-yearly) at such rate as may be fixed by the Corporation from time to time and on satisfaction of Continued Insurability of the Life Assured and/or Proposer (if LIC’s Premium Waiver Benefit Rider is opted for) on the basis of information, documents and reports that are already available and any additional information in this regard if and as may be required in accordance with the Underwriting Policy of the Corporation at the time of revival, being furnished by the Policyholder/Life Assured/Proposer.

The Corporation reserves the right to accept at original terms, accept with modified terms or decline the revival of a discontinued policy. The revival of a discontinued policy shall take effect only after the same is approved, accepted and revival receipt is issued by the Corporation.

The rate of interest applicable for revival under this plan for every 12 months’ period from 1st May to 30th April shall not exceed 10 year G-Sec Rate as p.a. compounding half-yearly as at the last trading day of previous financial year plus 3% or the yield earned on the Corporation’s Non-Linked fund plus 1% whichever is higher. For the 12 months period commencing from 1st May, 2021 to 30th April, 2022, the applicable interest rate shall be 9.5% p.a. compounding half yearly.

Revival of rider(s), if opted for, will be considered along with revival of the Base Policy, and not in isolation.

Paid-up value-

(Applicable in case of Limited Premium payment policies only)

If less than two full years premiums have been paid in respect of this policy and any subsequent premium be not duly paid, all the benefits under this policy shall cease after the expiry of grace period from the date of First Unpaid Premium and nothing shall be payable.

If, after atleast two full years’ premiums have been paid and any subsequent premiums be not duly paid, this policy shall not be wholly void, but shall subsist as a paid-up policy till the end of policy term.

The Sum Assured on Death under a paid-up policy shall be reduced to such a sum, called ‘Death Paid-up Sum Assured’ and shall be equal to Sum Assured on Death multiplied by the ratio of the total period for which premiums have already been paid bears to the maximum period for which premiums were originally payable. In addition to the Death Paid-up Sum Assured, Guaranteed Additions accrued up to the date of First Unpaid Premium, shall also be payable on death.

The Sum Assured on Maturity under a paid-up policy shall be reduced to such a sum called ‘Maturity Paid-up Sum Assured’ and shall be equal to [(Sum Assured on Maturity plus total amount of Survival Benefits payable under the policy) multiplied by the ratio of the total period for which premiums have already been paid bears to the maximum period for which premiums were originally payable] less total amount of Survival Benefits already paid under the policy. In addition to the Maturity Paid-up Sum Assured, the Guaranteed Additions accrued up to the date of First Unpaid Premium shall also be payable on maturity.

Under a Paid-up policy, accrued Guaranteed shall be payable for the duration for which the policy was in-force, i.e. for the duration for which all the premiums have been paid. Hence, under a paidup policy, the Guaranteed Addition for the policy year in which the last premium is received will be added on proportionate basis in proportion to the premium received for that year.

Surrender-

Under Single Premium payment, the policy can be surrendered by the Policyholder at any time during the policy term. Under Limited Premium payment, the policy can be surrendered by the policyholder at any time during the policy term provided two full years’ premiums have been paid.

On surrender of the policy, the Corporation shall pay the Surrender Value equal to higher of Guaranteed Surrender Value or Special Surrender Value.

The Special Surrender Value is reviewable and shall be determined by the Corporation from time to time subject to prior approval of IRDAI.

The Guaranteed Surrender Value payable under the policy shall be:

Under Single Premium Payment policies-

- During the policy term within the first three policy years: 75% of the Single Premium

- During the policy term after the third policy year: 90% of the Single Premium

Single Premium for Base policy referred above shall not include taxes, rider premium(s) and extra premium, if any

In addition, the surrender value of accrued Guaranteed Additions, if any, i.e. accrued Guaranteed Additions multiplied by GSV factor applicable to the accrued Guaranteed Additions shall also be payable

Under Limited Premium Payment policies-

The Guaranteed Surrender Value payable during the policy term shall be equal to the total premiums paid (excluding any extra premium, any premiums for rider(s), if opted for and taxes), multiplied by the Guaranteed Surrender Value factor applicable to total premiums paid plus accrued Guaranteed Additions multiplied by GSV factor applicable to accrued Guaranteed Additions less survival benefits already paid if any.

Policy Loan-

Loan can be available under the Policy subject to the following terms and conditions, within the surrender value of the policy for such amounts and on such further terms and conditions as the Corporation may fix from time to time:

i)- Under Single Premium Payment policies, loan can be availed at any time during the policy term after three months from the completion of the policy (i.e. three months from the Date of issuance of policy) or after expiry of the free-look period, whichever is later.

Under Limited Premium Payment policies, loan can be availed provided at least two full years’ premiums have been paid.

ii)- The maximum Loan that can be granted shall be as under-

Under Single Premium payment policies: 75 % of Surrender Value.

Under Limited Premium payment policies-

- For in-force policies : upto 90% of Surrender Value

- For paid-up policies : upto 80% of Surrender Value

The rate of loan interest applicable for full loan term, for the loan to be availed under this product for every 12 months period from 1st May to 30th April shall not exceed 10 year G-Sec Rate p.a. compounding half-yearly as at the last trading date of previous financial year plus 3% (inclusive of a spread of 2% over G-Sec Rate and loan servicing charge of 1% ) or the yield earned on the Corporation’s Non-Linked fund plus 100 basis points, whichever is higher. For loan sanctioned during the 12 months’ period commencing from 1st May, 2021 to 30th April, 2022, the applicable interest rate shall be 9.5% p.a. compounding half-yearly.

Any loan outstanding along with interest shall be recovered from the claim proceeds at the time of exit.

Tuesday, October 12, 2021

Monday, October 04, 2021

LIC Jeevan Akshay - VII (Plan No. 857)

A Non-Linked, Non-Participating, Individual Immediate Annuity Plan

Introduction-

- This is an Immediate Annuity plan wherein the Policyholder has an option to choose type of annuity from 10 available options on payment of a lump sum amount.

- The annuity rates are guaranteed at the inception of the policy and annuities are payable throughout the lifetime of Annuitant(s).

Annuity Options-

The available annuity options under this plan are as under-

- Option A: Immediate Annuity for life.

- Option B: Immediate Annuity with guaranteed period of 5 years and life thereafter.

- Option C: Immediate Annuity with guaranteed period of 10 years and life thereafter.

- Option D: Immediate Annuity with guaranteed period of 15 years and life thereafter.

- Option E: Immediate Annuity with guaranteed period of 20 years and life thereafter.

- Option F: Immediate Annuity for life with return of Purchase Price.

- Option G: Immediate Annuity for life increasing at a simple rate of 3% p.a.

- Option H: Joint Life Immediate Annuity for life with a provision for 50% of the annuity to the Secondary Annuitant on death of the Primary Annuitant.

- Option I: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives.

- Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of last survivor.

Annuity option once chosen cannot be altered.

Benefits

Benefits payable under above options are

Option A-

- The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of annuity payment.

- On death of Annuitant, nothing shall be payable and the annuity payment shall cease immediately.

Option B,C,D,E -

- The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of annuity payment.

- On death of the Annuitant during the guaranteed period of 5/10/15/20 years, the annuity shall be payable to the nominee(s) till the end of the guaranteed period.

- On death of the Annuitant after the guaranteed period, nothing shall be payable and the annuity payment shall cease immediately.

Option F-

- The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of annuity payment.

- On death of the annuitant, the annuity payment shall cease immediately and Purchase Price shall be payable to nominee(s) as per the option exercised by the Annuitant.

Option G-

- The annuity payments shall be made in arrears for as long as the Annuitant is alive, as per the chosen mode of annuity payment. The annuity payment will be increased by a simple rate of 3% per annum for each completed policy year.

- On death of annuitant nothing shall be payable and the annuity payment shall cease immediately.

Option H-

- The annuity payments shall be made in arrears for as long as the Primary Annuitant is alive, as per the chosen mode of annuity payment.

- On death of Primary Annuitant, 50% of the annuity amount shall be payable to the surviving Secondary Annuitant as long as the Secondary Annuitant is alive. The annuity payments will cease on the subsequent death of the Secondary Annuitant.

- If the Secondary Annuitant predeceases the Primary Annuitant, the annuity payments shall continue to be paid and will cease upon the death of the Primary Annuitant.

Option I-

- 100% of the annuity amount shall be paid in arrears for as long as the Primary Annuitant and/or Secondary Annuitant is alive, as per the chosen mode of annuity payment.

- On death of the last survivor, the annuity payments will cease immediately and nothing shall be payable.

Option J-

- 100% of the annuity amount shall be paid in arrears for as long as the Primary Annuitant and/or Secondary Annuitant is alive, as per the chosen mode of annuity payment.

- On death of the last survivor, the annuity payments will cease immediately and Purchase Price shall be payable to the nominee(s) as per the option exercised by the Primary Annuitant.

Eligibility Criteria-

(i)- Minimum Purchase Price - ₹1,00,000/- subject to Minimum Annuity as specified below.

Note: The above mentioned minimum purchase price would be increased appropriately to meet minimum annuity criterion as specified below.

For Purchase Price less than ₹1,50,000/-, annuity rates given under this plan shall be reduced with Reduction Factors as given in Para 7 below.

(ii)- Maximum Purchase Price - No Limit

(iii)- Minimum Age at Entry - 30 years (completed)

(iv)- Maximum Age at Entry - 85 years (completed) except Option F / 100 years (completed) for Option F

(v)- Minimum Annuity -

Joint Life: The joint life annuity can be taken between any two lineal descendant/ascendant of a family (i.e. Grandparent, Parent, Children, Grandchildren) or spouse or siblings. yearly plus 300 basis points. The 10 year G-Sec rate shall be as at last trading date of previous financial year. The calculated interest rate shall be applicable for full term of Loan.

For the loan sanctioned during the 12 months period commencing from 1st May, 2020 to 30th April, 2021, the applicable interest rate is 9.50% p.a. effective for entire term of the loan.

Any change in basis of determination of interest rate for policy loan shall be subject to prior approval of IRDAI.

Options-

Options available for payment of Death Benefit-

Under the annuity options where the benefit is payable on death i.e. Option F and Option J, the Annuitant(s) will have to choose one of the following options for the payment of the death benefit to the nominee(s).The death claim amount shall then be paid to the nominee(s) as per the option exercised by the Annuitant(s) and no alteration whatsoever shall be allowed to be made by the nominee(s).

Lumpsum Death Benefit- Under this option the entire Purchase Price shall be payable to the nominee(s) in lumpsum.

Annuitization of Death Benefit- Under this option the benefit amount payable on death i.e. Purchase Price shall be utilized for purchasing an Immediate Annuity from the Corporation for nominee(s). The annuity amount payable to the nominee(s) on the admission of death claim shall be based on the age of nominee(s) and immediate annuity rates prevailing as on the date of death of Annuitant (last survivor in case of Joint Life Annuity). This option can be opted for full or part of the benefit amount payable on death. However, the annuity payments for each nominee(s) shall be subject to the eligibility conditions of the annuity plan available at that time and then prevailing Regulatory provisions on the minimum limits for annuities.

In Instalment- Under this option the benefit amount payable on death i.e. Purchase Price can be received in instalments over the chosen period of 5 or 10 or 15 years instead of lumpsum amount. This option can be exercised for full or part of the Death Benefit payable under the policy. The amount opted by the Annuitant(s) (i.e. net claim amount) can be either in absolute value or as a percentage of the total claim proceeds payable.

The instalments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum instalment amount for different modes of payments being as under:

If the Net Claim Amount is less than the required amount to provide the minimum installment amount as per the option exercised by the Annuitant(s), the claim proceed shall be paid in lumpsum only.

For all the instalment payment options commencing during the 12 months’ period from 1st May to 30th April, the interest rate applicable for arriving at the instalment amount shall be annual effective rate equal to the 10 year G-Sec rate p.a. compounding half-yearly minus 200 basis points; where, the 10 year G-Sec rate shall be as at last trading day of previous financial year.

Accordingly, for the 12 months’ period commencing from 1st May, 2020 to 30th April, 2021, the applicable interest rate for the calculation of instalment amount shall be 4.71% p.a. effective.

For example, if this option has been exercised for the Net Claim Amount of ₹10,00,000/-, the amount of each instalment payable in advance for instalment payment options commencing during the 12 months’ period beginning from 1st May, 2020 to 30th April, 2021, shall be as below:

Option to take Annuity by NPS subscriber-

The annuity options as allowed as per PFRDA Regulations shall be available to NPS subscribers.

If a Government Sector NPS subscriber purchases this plan as a Default Option, then Option J shall be available to the subscriber whose spouse is surviving on the date of purchase. Option F shall be available to the subscriber in the absence of his or her spouse. Thereafter on the death of subscriber and his or her spouse, the purchase price shall be used to purchase annuity Option F or J on the life of living dependant mother/father and shall be subject to the eligibility conditions of the annuity plan available at that time.

Subject to the specific Plan features, all other terms and condition including the Default Option applicable shall be as per the Rules, Regulations, Guidelines, and Circulars etc. issued by Pension Fund Regulatory and Development Authority (PFRDA) from time to time in this regard.

Option to take the plan for the benefit of dependent person with disability (Divyangjan)-

If the Proposer has a dependant person with disability (Divyangjan) , the plan can be purchased for the benefit of Divyangjan as Nominee/Secondary Annuitant, subject to minimum Purchase Price of ₹50,000/- without any limit on minimum annuity payment and minimum age at entry (for Divyangjan life), in following ways;

- The Proposer can purchase Immediate Annuity with Return of Purchase Price (Option F) on own life. In case of death of the Annuitant (Proposer), the Death Benefit shall compulsorily be utilized to purchase Immediate Annuity (as per option chosen by the Annuitant) on the life of the Divyangjan.

- The Proposer can purchase Joint Life Annuity (Option I or J) with Divyangjan as Secondary Annuitant.

Loan-

Loan facility shall be available at any time after three months from the completion of policy (i.e. 3 months from the date of issuance of policy) or after expiry of the free-look period, whichever is later, subject to terms and conditions as the Corporation may specify from time to time.

As per current provisions, policy loan shall be allowed under the following annuity options only

Option F: Immediate Annuity for life with return of Purchase Price.

Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of last survivor.

The maximum amount of loan that can be granted under the policy shall be such that the effective annual interest amount payable on loan does not exceed 50% of the annual annuity amount and shall be subject to maximum of 80% of Surrender Value. Loan interest will be recovered from annuity amount payable under the policy. The loan outstanding shall be recovered from the claim proceeds at the time of exit.

The loan interest rate for all the loans commencing during the 12 months’ period from 1st May to 30th April, shall be annual effective rate not exceeding 10 year G-Sec rate p.a. compounding half yearly plus 300 basis points. The 10 year G-Sec rate shall be as at last trading date of previous financial year. The calculated interest rate shall be applicable for full term of Loan.

For the loan sanctioned during the 12 months’ period commencing from 1st May, 2020 to 30th April, 2021, the applicable interest rate is 9.50% p.a. effective for entire term of the loan.

Any change in basis of determination of interest rate for policy loan shall be subject to prior approval of IRDAI.

LIC Jeevan Shiromani (Plan No 947)

(A Non-Linked, Participating, Individual, Life Assurance Savings Plan)

LIC's Jeevan Shiromani plan offers a combination of protection and savings. This plan is specially designed for High Net-worth Individuals. This plan provides financial support for the family in case of unfortunate death of the policyholders during the policy term. Periodic payments shall also be made on survival of the policyholder at specified durations during the policy term and a lump sum payment to the surviving policyholder at the me of maturity. In addition, this plan also provides for payment of a lumpsum amount equal to 10% of the chosen Basic Sum Assured on diagnosis of any of the specified Critical Illnesses. This plan also takes care of liquidity needs through loan facility.

Death Benefit-

On death during first five years-

Death Benefit defined as sum of “Sum Assured on Death” and accrued Guaranteed Addition shall be payable.

On death after completion of five policy years but before the date of Maturity-

Death Benefit defined as sum of “Sum Assured on Death” and accrued Guaranteed Addition and Loyalty Addition, if any, shall be payable.

Where “Sum Assured on Death” is defined as the higher of 125% of Basic Sum Assured or 7 times of annualized premium.

This death benefit shall not be less than 105% of all the premiums paid up to the date of death.

Premiums referred above excludes taxes, extra premium and rider premium(s), if any.

Survival Benefit-

Provided the policy is in-force, on the Life Assured surviving to each of the specified durations during the policy term, a fixed percentage of Basic Sum Assured shall be payable. The fixed percentage for various policy terms is as below-

- For policy term 14 years: 30% of Basic Sum Assured on each of 10th and 12th policy anniversary

- For policy term 16 years: 35% of Basic Sum Assured on each of 12th and 14th policy anniversary

- For policy term 18 years: 40% of Basic Sum Assured on each of 14th and 16th policy anniversary

- For policy term 20 years: 45% of Basic Sum Assured on each of 16th and 18th policy anniversary

Maturity Benefit-

On Life Assured surviving the stipulated Date of Maturity provided the policy is in-force, “Sum Assured on Maturity” along with accrued Guaranteed Additions and Loyalty Addition, if any, shall be payable. Where “Sum Assured on Maturity” as a fixed percentage of Basic Sum Assured is as below-

- For policy term 14 years: 40% of Basic Sum Assured

- For policy term 16 years: 30% of Basic Sum Assured

- For policy term 18 years: 20% of Basic Sum Assured

- For policy term 20 years: 10% of Basic Sum Assured

The Life Assured shall have an option to receive the Maturity Benefit in lumpsum as specified above and/or in instalments.

Guaranteed Additions-

Provided the policy is in-force, Guaranteed Additions, at the rate of ₹ 50 per thousand Basic Sum Assured for the first five years and ₹ 55/- per thousand Basic Sum Assured from 6th policy year till the end of premium paying term, will be added to the policy at the end of each policy year for which full year’s premiums have been paid. In case the premiums are not duly paid, the Guaranteed Additions shall cease to accrue under a policy.

In case of a paid-up policy or on surrender of a policy the Guaranteed Addition for the policy year in which the last premium is received will be added on proportionate basis in proportion to the premium received for that year.

Inbuilt Critical Illness Benefit-

Benefit-

On first diagnosis of any one of the 15 critical illnesses as mentioned below, provided the policy is in-force on the date of diagnosis by payment of all premiums due under the policy, the following benefits/ facilities shall be available.

(A)- Lumpsum Benefit- Inbuilt Critical Illness Benefit equal to 10% of Basic Sum Assured shall be payable provided the claim is admissible.

(B)- Option to defer the payment of premiums if a claim under Inbuilt Critical Illness Benefit is paid: When a claim under Inbuilt Critical Illness Benefit is admitted, life assured will have an option to defer the payment of premiums falling due within 2 years from the date of admission of Critical Illness claim under the policy (including rider premiums). The deferment of premiums shall be allowed for a period of 2 years from the date of admission of Critical Illness claim and subsequent premiums, if any, shall be payable on their due dates. No interest shall be charged from the life assured for deferred premiums within the period of such deferment. During this period, if any outstanding premium(s) are not paid, and any of the benefits payable under the base policy and/or rider(s) become due, the applicable benefit(s) shall be payable as under an in-force policy after the deduction of all the premiums due under the policy.

(C)- Medical Second Opinion: The policyholder will have facility of taking Medical Second Opinion through the available healthcare providers internationally or through reputed hospitals in India or through specialist doctors available in different places depending on the arrangement in this regard by the Corporation. The Medical Second Opinion shall not include the cost of any diagnostic tests. This facility shall be available only once during the policy term with no extra cost.

The Corporation will not be responsible for the opinion provided by Medical Second Opinion. This provision for all or either of the options of Medical Second Opinion is subject to availability of the facility and arrangements made by the Corporation and as intimated in this regard.

Conditions and restrictions under Inbuilt Critical Illness Benefit-

(A)- Inbuilt Critical Illness benefit will be payable only after the Corporation is satisfied on the basis of available medical evidence that the specified illness has occurred. However, in some illnesses covered under this benefit, a specific deferment period applies to establish permanence of the illness covered.

(B)- The inbuilt Critical Illness Benefit shall be payable only once during the currency of the policy. Under a paid-up policy proportionate benefit amount shall be payable as mentioned below.

(C)- The list and definitions of the 15 Critical Illness conditions covered under this benefit-

1. CANCER OF SPECIFIED SEVERITY

(1)- A malignant tumor characterized by the uncontrolled growth and spread of malignant cells with invasion and destruction of normal tissues. This diagnosis must be supported by histological evidence of malignancy. The term cancer includes leukemia, lymphoma and sarcoma.

(2)- The following are excluded-

- All tumors which are histologically described as carcinoma in situ, benign, pre-malignant, borderline malignant, low malignant potential, neoplasm of unknown behavior, or non-invasive, including but not limited to: Carcinoma in situ of breasts, Cervical dysplasia CIN-1, CIN -2 and CIN-3.

- Any non-melanoma skin carcinoma unless there is evidence of metastases to lymph nodes or beyond

- Malignant melanoma that has not caused invasion beyond the epidermis

- All tumors of the prostate unless histologically classified as having a Gleason score greater than 6 or having progressed to at least clinical TNM classification T2N0M0

- All Thyroid cancers histologically classified as T1N0M0 (TNM Classification) or below;

- Chronic lymphocytic leukemia less than RAI stage 3

- Non-invasive papillary cancer of the bladder histologically described as TaN0M0 or of a lesser classification,

- All Gastro-Intestinal Stromal Tumors histologically classified as T1N0M0 (TNM Classification) or below and with mitotic count of less than or equal to 5/50 HPFs;

- All tumors in the presence of HIV infection.

2. OPEN CHEST CABG-

- The actual undergoing of heart surgery to correct blockage or narrowing in one or more coronary artery(s), by coronary artery bypass grafting done via a sternotomy (cutting through the breast bone) or minimally invasive keyhole coronary artery bypass procedures. The diagnosis must be supported by a coronary angiography and the realization of surgery has to be confirmed by a cardiologist.

- The following are excluded: Angioplasty and/or any other intra-arterial procedures

3. MYOCARDIAL INFARCTION

(First Heart Attack of specific severity)

(I)- The first occurrence of heart attack or myocardial infarction, which means the death of a portion of the heart muscle as a result of inadequate blood supply to the relevant area. The diagnosis for Myocardial Infarction should be evidenced by all of the following criteria:

- A history of typical clinical symptoms consistent with the diagnosis of acute myocardial infarction (For e.g. typical chest pain)

- New characteristic electrocardiogram changes

- Elevation of infarction specific enzymes, Troponins or other specific biochemical markers.

(II)- The following are excluded:

- Other acute Coronary Syndromes

- Any type of angina pectoris

- A rise in cardiac biomarkers or Troponin T or I in absence of overt ischemic heart disease OR following an intraarterial cardiac procedure.

4. KIDNEY FAILURE REQUIRING REGULAR DIALYSIS

End stage renal disease presenting as chronic irreversible failure of both kidneys to function, as a result of which either regular renal dialysis (hemodialysis or peritoneal dialysis) is instituted or renal transplantation is carried out. Diagnosis has to be confirmed by a specialist medical practitioner.

5. MAJOR ORGAN /BONE MARROW TRANSPLANT (as recipient)

(I)- The actual undergoing of a transplant of:

- One of the following human organs: heart, lung, liver, kidney, pancreas, that resulted from irreversible end-stage failure of the relevant organ, or

- Human bone marrow using hematopoietic stem cells. The undergoing of a transplant has to be confirmed by a specialist medical practitioner.

(II)- The following are excluded:

- Other stem-cell transplants

- Where only islets of Langerhans are transplanted

6. STROKE RESULTING IN PERMANENT SYMPTOMS

(I)- Any cerebrovascular incident producing permanent neurological sequelae. This includes infarction of brain tissue, thrombosis in an intracranial vessel, hemorrhage and embolization from an extracranial source. Diagnosis has to be confirmed by a specialist medical practitioner and evidenced by typical clinical symptoms as well as typical findings in CT Scan or MRI of the brain. Evidence of permanent neurological deficit lasting for at least 3 months has to be produced.

(II)- The following are excluded:

- Transient ischemic attacks (TIA)

- Traumatic injury of the brain

- Vascular disease affecting only the eye or optic nerve or vestibular functions.

7. PERMANENT PARALYSIS OF LIMBS

Total and irreversible loss of use of two or more limbs as a result of injury or disease of the brain or spinal cord. A specialist medical practitioner must be of the opinion that the paralysis will be permanent with no hope of recovery and must be present for more than 3 months.

8. MULTIPLE SCLEROSIS WITH PERSISTING SYMPTOMS

(I)- The unequivocal diagnosis of Definite Multiple Sclerosis confirmed and evidenced by all of the following:

- investigations including typical MRI findings which unequivocally confirm the diagnosis to be multiple sclerosis and

- there must be current clinical impairment of motor or sensory function, which must have persisted for a continuous period of at least 6 months.

(II)- Other causes of neurological damage such as SLE and HIV are excluded.

9. AORTIC SURGERY

The actual undergoing of major surgery to repair or correct an aneurysm, narrowing, obstruction or dissection of the aorta through surgical opening of the chest or abdomen. For the purpose of this definition, aorta shall mean the thoracic and abdominal aorta but not its branches.

10. PRIMARY (IDIOPATHIC) PULMONARY HYPERTENSION

(I)- An unequivocal diagnosis of Primary (Idiopathic) Pulmonary Hypertension by a Cardiologist or specialist in respiratory medicine with evidence of right ventricular enlargement and the pulmonary artery pressure above 30 mm of Hg on Cardiac Cauterization. There must be permanent irreversible physical impairment to the degree of at least Class IV of the New York Heart Association Classification of cardiac impairment.

(II)- The NYHA Classification of Cardiac Impairment are as follows:

- Class III: Marked limitation of physical activity. Comfortable at rest, but less than ordinary activity causes symptoms.

- Class IV: Unable to engage in any physical activity without discomfort. Symptoms may be present even at rest.

(III)- Pulmonary hypertension associated with lung disease, chronic hypoventilation, pulmonary thromboembolic disease, drugs and toxins, diseases of the left side of the heart, congenital heart disease and any secondary cause are specifically excluded.

11. ALZHEIMER’S DISEASE/ DEMENTIA

Deterioration or loss of intellectual capacity as confirmed by clinical evaluation and imaging tests, arising from Alzheimer's Disease or irreversible organic disorders, resulting in significant reduction in mental and social functioning requiring the continuous supervision of the Life Assured for a minimum period of 6 months from date of diagnosis. This diagnosis must be supported by the clinical confirmation of an appropriate Registered Medical practitioner who is also a Neurologist and supported by the Corporation’s appointed doctor.

The following are excluded:

- Non-organic disease such as neurosis and psychiatric illnesses; and

- Alcohol-related brain damage.

12. BLINDNESS

(I)- Total, permanent and irreversible loss of all vision in both eyes as a result of illness or accident.

(II)- The Blindness is evidenced by:

- corrected visual acuity being 3/60 or less in both eyes or ;

- the field of vision being less than 10 degrees in both eyes.

(III)-The diagnosis of blindness must be confirmed and must not be correctable by aids or surgical procedure.

13. THIRD DEGREE BURNS

There must be third-degree burns with scarring that cover at least 20% of the body’s surface area. The diagnosis must confirm the total area involved using standardized, clinically accepted, body surface area charts covering 20% of the body surface area.

14. OPEN HEART REPLACEMENT OR REPAIR OF HEART VALVES

The actual undergoing of open-heart valve surgery is to replace or repair one or more heart valves, as a consequence of defects in, abnormalities of, or disease-affected cardiac valve(s). The diagnosis of the valve abnormality must be supported by an echocardiography and the realization of surgery has to be confirmed by a specialist medical practitioner. Catheter based techniques including but not limited to, balloon valvotomy/valvuloplasty are excluded.

15. BENIGN BRAIN TUMOR

(1)- Benign brain tumor is defined as a life threatening, non-cancerous tumor in the brain, cranial nerves or meninges within the skull. The presence of the underlying tumor must be confirmed by imaging studies such as CT scan or MRI.

(2)- This brain tumor must result in at least one of the following and must be confirmed by the relevant medical specialist.

- Permanent Neurological deficit with persisting clinical symptoms for a continuous period of at least 90 consecutive days or

- Undergone surgical resection or radiation therapy to treat the brain tumor.

The following conditions are excluded: Cysts, Granulomas, malformations in the arteries or veins of the brain, hematomas, abscesses, pituitary tumors tumors of skull bones and tumors of the spinal cord.

Waiting Period-

A waiting period of 90 days will apply from the date of commencement of risk or date of revival of risk cover, whichever is later, to the first diagnosis of the Critical Illness under consideration. This would mean that this benefit shall terminate if any of the contingencies mentioned in Condition 3.II. of Part C of this policy document occurs-

- At any time on or after the date on which the risk under the Policy has commenced but before the expiry of 90 days reckoned from that date or

- before the expiry of 90 days from the date of Revival.

However, waiting period will not apply to conditions arising directly out of accident.

Survival Period-

A survival period of 30 days is applicable from the date of diagnosis of Critical Illness listed above. If death occurs within the survival period, no inbuilt critical illness benefit shall be payable.

Exclusions-

The Corporation shall not be liable to pay any of the benefits under Inbuilt Critical Illnesses Benefit if the critical illness has occurred directly or indirectly as a result of any of the following

- Any of the listed critical illness conditions where death occurs within 30 days from the date of diagnosis

- Any sickness condition related to the critical illnesses listed above manifesting itself within 90 days of the commencement of risk or revival of risk cover, whichever is later.

- Intentionally self-inflicted injury or attempted suicide, irrespective of mental condition.

- Alcohol or solvent abuse, or the taking of drugs except under the direction of a registered medical practitioner.

- War, invasion, hostilities (whether war is declared or not), civil war, rebellion, revolution or taking part in a riot or civil commotion.

- Taking part in any act of a criminal nature.

- Any Pre-existing medical condition.

- HIV or AIDS

- Failure to seek medical or follow medical advice (i.e. failure to undergo tests or treatments that a prudent person would normally undergo as recommended by a Medical Practitioner.

- Radioactive contamination due to nuclear accident.

Termination of Inbuilt Critical Illness Benefit-

The Inbuilt Critical Illness Benefit will terminate on the earliest occurrence of any of the following events

(a) The date on which the claim is paid in respect of this benefit; or

(b) The date of expiry of policy term; or

(c) The date on which surrender benefit are settled under the policy; or

(d) On cancellation/termination of the policy for any reason; or

(e) On cancellation/termination of the policy by the Corporation on grounds of misrepresentation, fraud or nondisclosure established in terms of Section 45 of the Insurance Act, 1938, as amended from time to time; or

(f) On diagnosis of a Critical Illness within the waiting period

(g) Any critical illness manifesting itself during the waiting period is not admissible. The first admissible critical illness which is manifested, diagnosed and lodged after waiting period and during the currency of policy, once admitted for, shall preclude any further critical illness and therefore the benefit will terminate.

(h)

- If the insured event requires the surgical procedure to be performed, the procedure must be the usual treatment for the condition and be medically necessary;

- The Critical Illness benefit shall be payable only on confirmation of the diagnosis by a registered Medical Practitioner appointed/approved by the Corporation;

Rider Benefits-

The following 4 rider(s) are available under this policy:

- Accidental Death and Disability Benefit Rider

- New Term Assurance Rider

- Accident Benefit Rider

- New Critical Illness Benefit Rider

However, the eligible Life Assured can opt between either of the LIC’s Accidental Death and Disability Rider or LIC’s Accident Benefit Rider. Therefore, a maximum of three riders can be availed under this policy.

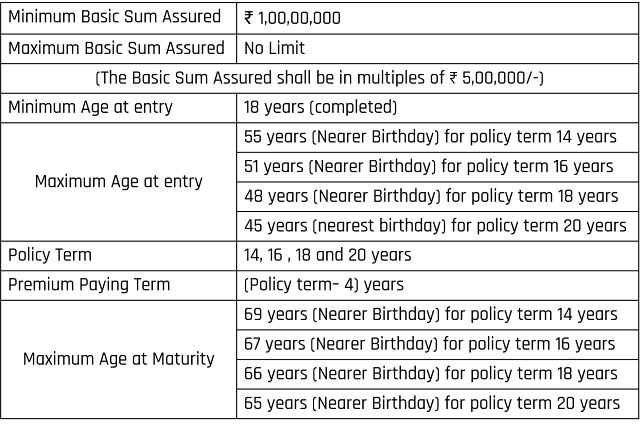

Eligibility Conditions and Other Restriction-

Date of Commencement of Risk under the Plan-

Risk will commence immediately from the date of acceptance of the risk.

Payment of Premiums-

- The policyholder has to pay the Premium on the due dates as specified in the Schedule of this Policy Document along with taxes, if any, as applicable from time to time.

- In case of death of Life Assured under an in-force policy wherein all the premiums due till the date of death have been paid and where the mode of payment of premium is other than yearly, balance premium(s), if any, falling due from the date of death and before the next policy anniversary shall be deducted from the claim amount.

- In case of claim under Inbuilt Critical Illness Benefit is paid and option to defer the payment of premiums is availed, during this deferment period of two years from the date of admission of Inbuilt Critical Illness Benefit claim if any of the benefits payable under the Base Policy and/or rider(s) become due, the applicable benefit(s) shall be payable as under an inforce policy after the deduction of all the premiums due under the policy. If the due premiums are not paid before the expiry of the deferment period of two years from the date of admission of Inbuilt Critical Illness Benefit claim, the Policy lapses.

The Corporation does not have any obligation to issue a notice that premium is due or for the amount that is due.

Grace period-

A grace period of 30 days shall be allowed for payment of yearly or half-yearly or quarterly premiums and 15 days for monthly premiums from date of First unpaid premium. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

If the death of the Life Assured occurs within the grace period but before the payment of the premium then due, the policy will still be valid and the benefits shall be paid after deductions of the said unpaid premium as also the balance premium(s), if any, falling due from the date of death and before the next policy anniversary.

The above grace period will also apply to rider premiums which are payable along with premium for Base Policy.

If an Inbuilt Critical Benefit claim is intimated within the grace period but before the payment of the premium then due, the policy will still be valid and the benefits shall be paid after deductions of the said unpaid premium.

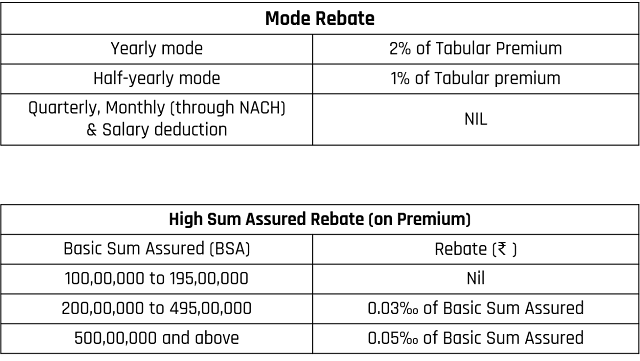

Rebates-

Revival-

An Insurance Policy would lapse on non-payment of due premium within the days of grace. A policy in lapsed condition may be revived during the life time of the Life Assured, but within the Revival Period and before the Date of Maturity, as the case may be. The revival shall be effected on payment of all the arrears of premium together with interest (compounding half yearly) at such rate as fixed by the Corporation from time to time and on satisfaction of Continued Insurability of the Life Assured on the basis of information, documents and reports that are already available and any additional information in this regard if and as may be required in accordance with the Underwriting Policy of the Corporation at the time of revival, being furnished by the Policyholder/Life Assured/Proposer.

The Corporation however, reserves the right to accept at original terms, accept with modified terms or decline the revival of a discontinued policy. The revival of the discontinued policy shall take effect only after the same is approved, accepted and revival receipt is issued by the Corporation.

If the revival period falls beyond the premium paying term and the policy is revived after the due date of survival benefit, then the difference between full Survival Benefit payable under in-force policy and Survival Benefit already paid considering paidup policy shall be paid to the policyholder.

Revival of Rider(s), if opted for, will only be considered along with the revival of the Base Policy and not in isolation.

Policy Loan-

Loan can be availed under this policy provided atleast one full year’s premium has been paid and on completion of one policy year subject to the following terms and conditions, within the surrender value of the policy for such amounts and on such further terms and conditions as the Corporation may fix from time to time.

(A)- The Policy shall be assigned absolutely to and held by the Corporation as security for the repayment of Loan and of the interest thereon.

(B)-The maximum loan as a percentage of surrender value shall be as under:

- For in-force policies – up to 90%

- For paid-up policies – up to 80%

(C)- Interest on Loan shall be paid on compounding half-yearly basis to the Corporation at the rate to be specified by the Corporation at the time of taking loan under this policy. The applicable interest rate shall be based on the method approved by IRDAI. The first payment of interest is to be made on the next Policy anniversary or on the date six months before the next Policy anniversary whichever immediately follows the date on which the Loan is sanctioned and every half year thereafter.

(D)- In the event of default in payment of loan interest on the due dates as herein mentioned above and when the outstanding loan amount along with interest is to exceed the surrender value, the Corporation would be entitled to foreclose such policies. Such policies when being foreclosed shall be entitled to payment of the difference of surrender value and the outstanding loan amount along with interest, if any.

(E)- Corporation is entitled to recover or recall the amount of the Loan with all due interest by giving 3 months’ notice In case the policy shall mature or become due for survival benefits or surrendered or becomes a claim by death, the Corporation shall become entitled to deduct the amount of outstanding Loan, together with all interest from the policy moneys.

Saturday, October 02, 2021

LIC Jeevan Umang

(A Non-Linked, Participating, Individual, Life Assurance Savings, Whole Life Plan)

LIC's Jeevan Umang is a non-linked, Participating, individual, whole life assurance plan which offers a combination of income and protection to your family. This plan provides for annual survival benefits from the end of the premium paying term till maturity and a lump sum payment at the time of maturity or on death of the policyholder during the policy term.

In addition, this plan also takes care of liquidity needs through loan facility.

Death Benefit-

On death of the Life Assured before the stipulated Date of maturity provided the policy is in-force then-

On death before the Date of commencement of Risk-

An amount equal to the total amount of premiums paid without interest excluding taxes, Extra Premium and Rider Premium, if any, shall be payable.

On death after the Date of commencement of Risk-

Death Benefit defined as the sum of “Sum Assured on Death”, vested Simple Reversionary Bonus and Final Additional Bonus, if any, shall be payable.

Where “Sum Assured on Death” is higher of 7 times of Annualized Premium or Basic Sum Assured.

This death benefit shall not be less than 105% of the total premiums paid (excluding taxes, Extra Premium and Rider(s) premiums, if any), up to the date of death.

Survival Benefit-

On the life assured surviving to the end of the premium paying term, provided the policy is in-force , a survival benefit equal to 8% of Basic Sum Assured shall be payable each year. The first survival benefit payment is payable at the end of premium paying term and thereafter on completion of each subsequent year till the Life Assured survives or till the policy anniversary prior to the date of maturity, whichever is earlier.

Maturity Benefit-

On the Life Assured surviving to the stipulated Date of Maturity, provided the policy is in-force, “Sum Assured on Maturity” along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any, shall be payable. Where “Sum Assured on Maturity” is equal to Basic Sum Assured.

Participation in profits-

Depending upon the Corporation’s experience with regard to policies issued under this plan, the policy shall participate in profits during the policy term.

Profit distribution during premium paying term-

Policies will be eligible for Simple Reversionary Bonus during premium paying term at such rate and on such terms as may be declared by the Corporation. These Reversionary Bonuses shall be declared annually on the Basic Sum Assured at the end of each financial year provided the policy is in-force.

In case the premiums are not duly paid, the policy shall cease to participate in future profits during the premium paying term irrespective of whether or not the policy has acquired paid up value.

Final Additional Bonus may also be declared under an in-force policy in the year when such policy results into a claim by death.

Final Additional Bonus shall not be payable under paid-up policy or on surrender of a policy during the premium paying term.

Profit distribution after premium paying term (applicable only for fully paid-up policies or for paid-up policies with Maturity Paid-up Sum Assured of ₹ 2 lakhs or more)-

Under a fully paid-up policy (where all premiums payable during the term of the policy stand paid) or in a paid-up policy with Maturity Paid-up Sum Assured of ₹ 2 lakhs or more, the terms for participation of profits after the premium paying term may be in a different form and on a differential scale depending on the Corporation’s experience under this plan at that time.

Final Additional Bonus may also be declared under such policy in the year when a policy results into a claim either by death or maturity.

Under a paid-up policy with Maturity Paid-up Sum Assured of less than ₹ 2 lakhs, the policy shall not participate in any future profits.

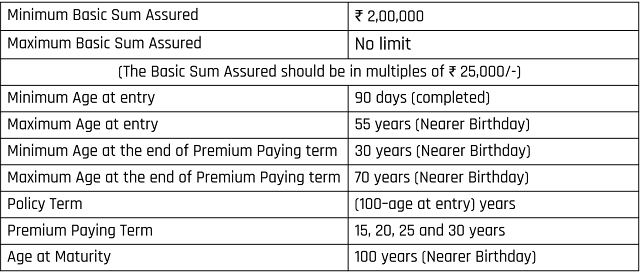

Eligibility Conditions and Other Restrictions-

Date of Commencement of Risk-

If the age at entry of the Life Assured is less than 8 years, the risk under this plan will commence either one day before the completion of 2 years from the date of commencement of policy or one day before the policy anniversary coinciding with or immediately following the completion of 8 years of age, whichever is earlier. For those aged 8 years or more at entry, risk will commence immediately from the date of issuance of policy.

Vesting of Policy on the Life of a Minor-

If the Life Assured is alive on the Date of Vesting and if a request in writing for surrendering the policy has not been received by Corporation before such Date of Vesting from the person entitled to the policy moneys, this policy shall automatically vest in the Life Assured on such Date of vesting.

Rider Benefits-

The following five riders are available under this policy-

- Accidental Death and Disability Benefit Rider

- New Term Assurance Rider

- Accident Benefit Rider

- New Critical Illness Benefit Rider

- Premium Waiver Benefit Rider

However, the eligible Life Assured can opt between either of the Accidental Death and Disability Rider or Accident Benefit Rider.

Accidental Death and Disability Benefit Rider/Accident Benefit Rider-

Under an in-force policy either of these riders can be opted for at any time within the premium paying term of the Base Policy provided, the outstanding premium paying term of the Base Policy as well as the rider is at least five years. Under the policy on the life of minors, this rider will be available from the policy anniversary following completion of age 18 years on receipt of specific request.

New Term Assurance Rider/New Critical Illness Benefit Rider-

These riders are available only at the inception of the policy on payment of additional premium.

Premium Waiver Benefit Rider-

Under an in-force policy, this rider can be opted for on the life of Proposer of the policy (as the Life assured is minor), at any time coinciding with the policy anniversary but within the premium paying term of the Base Policy provided the outstanding premium paying term of the Base Policy and the rider is at least five years. Further, this rider shall be allowed under the policy wherein the Life Assured is Minor at the time of opting this rider. The Rider term shall not exceed (25 minus age of the minor Life Assured at the time of opting this rider).

If this rider is opted for, on death of proposer, payment of premiums in respect of base policy falling due after the date of death till the expiry of rider term shall be waived. However, in such case, if the premium paying term of the base policy exceeds the rider term, all the further premiums due under the base policy from the date of expiry of this Premium Waiver Benefit Rider term shall be payable by the Life Assured. On non-payment of such premiums the policy would become paid-up.

Conditions of rider(s), if opted, are enclosed as endorsement to this policy.

Payment of Premiums-

The policyholder has to pay the Premium on the due dates during the premium paying term as specified in the Schedule of this Policy Document along with applicable taxes, if any, from time to time.

In case of death of Life Assured under an in-force policy wherein all the premiums due till the date of death have been paid and where the mode of payment of premium is other than yearly, balance premium(s), if any, falling due from the date of death and before the next policy anniversary shall be deducted from the claim amount.

The Corporation does not have any obligation to issue a notice that premium is due or for the amount that is due.

Grace Period-

A grace period of 30 days shall be allowed for payment of yearly or half-yearly or quarterly premiums and 15 days for monthly premiums from the date of First unpaid premium. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

If the death of the Life Assured occurs within the grace period but before the payment of the premium then due, the policy will still be valid and the benefits shall be paid after deductions of the said unpaid premium as also the balance premium(s), if any, falling due from the date of death and before the next policy anniversary.

The above grace period will also apply to rider premiums which are payable along with premium for base policy.

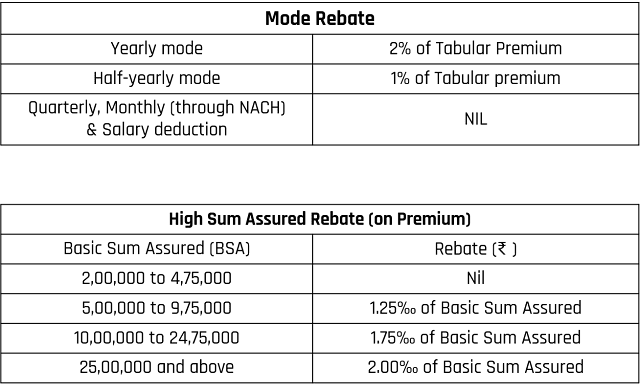

Rebates-

Revival-

An Insurance Policy would lapse on non-payment of due premium within the days of grace. A policy in lapsed condition may be revived during the life time of the Life Assured, but within the Revival Period. The revival shall be effected on payment of all the arrears of premium(s) together with interest (compounding half-yearly) at such rate as may be fixed by the Corporation from time to time and on satisfaction of Continued Insurability of the Life Assured and/or Proposer (if LIC’s Premium Waiver Benefit Rider is opted for) on the basis of information, documents and reports that are already available and any additional information in this regard if and as may be required in accordance with the Underwriting

Policy of the Corporation at the time of revival, being furnished by the Policyholder/Life Assured/Proposer.

The Corporation however, reserves the right to accept at original terms, accept with modified terms or decline the revival of a discontinued policy. The revival of the discontinued policy shall take effect only after the same is approved, accepted and revival receipt is issued by the Corporation.

If revival period falls beyond the premium paying term and the policy is revived after the due date of survival benefit(s), then-

- the unpaid survival benefit(s) (applicable in case of paid-up policy wherein the Maturity Paid-up Sum Assured is less than 2 lakhs) or

- the difference between Survival benefits on full Basic Sum Assured and Survival benefits on Maturity Paid-up Sum Assured (applicable in case of paid-up policy wherein the Maturity Paid-up Sum Assured equal to or greater than 2 lakhs) shall be paid to the policy holder.

Revival of Rider(s), if opted for, will only be considered along with the revival of the Base Policy and not in isolation.

Policy Loan-

Loan shall be available under the policy subject to the following terms and conditions, within the surrender value of the policy for such amounts and on such further terms and conditions as the Corporation may fix from time to time-

- Loan can be availed provided at least two full years’ premiums have been paid.

- If loan is availed during the premium paying term-

- The maximum loan as a percentage of surrender value shall be as under:

- For in-force policies – up to 90%

- For paid-up policies – up to 80%

- If loan is availed after the premium paying term: The maximum permissible amount of new loan (where no previous loan taken earlier is outstanding) for policies which are entitled for survival benefits shall be arrived at in such a way that the effective annual interest amount payable on loan does not exceed 50% of the annual survival benefit payable under the policy.

- However, the Corporation reserves the right to determine the loan amount to be granted.

- The loan during the minority of Life Assured can be availed by the Proposer provided the loan is raised for the benefit of the minor Life Assured. The Policy shall be assigned absolutely to and held by the Corporation as security for the repayment of Loan and of the interest thereon;

- If loan is availed during the premium paying term: Interest on Loan during the premium paying term shall be paid on compounding half-yearly basis to the Corporation at the rate to be specified by the Corporation at the time of taking loan under this policy. The applicable interest rate shall be based on the method approved by IRDAI. The first payment of interest is to be made on the next Policy anniversary or on the date six months before the next Policy anniversary whichever immediately follows the date on which the Loan is sanctioned and every half year thereafter.

- In case if the loan is not repaid during the premium paying term and if there is default in the interest payment, then due Interest on the loan shall be recovered from survival benefits due or any other amount payable under the policy;

- If loan is availed after the premium paying term: Interest on the loan shall be recovered from the survival benefits and at the rate which shall be specified by the Corporation when the loan is made;

- In the event of default in payment of loan interest on the due date as herein mentioned above and when the outstanding loan amount along with interest is to exceed the surrender value, the Corporation would be entitled to foreclose such policies. Such policies when being foreclosed shall be entitled to payment of the difference of surrender value and the outstanding loan amount along with interest, if any ;

- Corporation is entitled to recover or recall the amount of the Loan with all due interest by giving 3 months’ notice;

- In case the policy shall mature or is surrendered or becomes a claim by death, the Corporation shall become entitled to deduct the amount of outstanding Loan, together with all interest from the policy moneys.