LIC Jeevan Shiromani (Plan No 947)

(A Non-Linked, Participating, Individual, Life Assurance Savings Plan)

LIC's Jeevan Shiromani plan offers a combination of protection and savings. This plan is specially designed for High Net-worth Individuals. This plan provides financial support for the family in case of unfortunate death of the policyholders during the policy term. Periodic payments shall also be made on survival of the policyholder at specified durations during the policy term and a lump sum payment to the surviving policyholder at the me of maturity. In addition, this plan also provides for payment of a lumpsum amount equal to 10% of the chosen Basic Sum Assured on diagnosis of any of the specified Critical Illnesses. This plan also takes care of liquidity needs through loan facility.

Death Benefit-

On death during first five years-

Death Benefit defined as sum of “Sum Assured on Death” and accrued Guaranteed Addition shall be payable.

On death after completion of five policy years but before the date of Maturity-

Death Benefit defined as sum of “Sum Assured on Death” and accrued Guaranteed Addition and Loyalty Addition, if any, shall be payable.

Where “Sum Assured on Death” is defined as the higher of 125% of Basic Sum Assured or 7 times of annualized premium.

This death benefit shall not be less than 105% of all the premiums paid up to the date of death.

Premiums referred above excludes taxes, extra premium and rider premium(s), if any.

Survival Benefit-

Provided the policy is in-force, on the Life Assured surviving to each of the specified durations during the policy term, a fixed percentage of Basic Sum Assured shall be payable. The fixed percentage for various policy terms is as below-

- For policy term 14 years: 30% of Basic Sum Assured on each of 10th and 12th policy anniversary

- For policy term 16 years: 35% of Basic Sum Assured on each of 12th and 14th policy anniversary

- For policy term 18 years: 40% of Basic Sum Assured on each of 14th and 16th policy anniversary

- For policy term 20 years: 45% of Basic Sum Assured on each of 16th and 18th policy anniversary

Maturity Benefit-

On Life Assured surviving the stipulated Date of Maturity provided the policy is in-force, “Sum Assured on Maturity” along with accrued Guaranteed Additions and Loyalty Addition, if any, shall be payable. Where “Sum Assured on Maturity” as a fixed percentage of Basic Sum Assured is as below-

- For policy term 14 years: 40% of Basic Sum Assured

- For policy term 16 years: 30% of Basic Sum Assured

- For policy term 18 years: 20% of Basic Sum Assured

- For policy term 20 years: 10% of Basic Sum Assured

The Life Assured shall have an option to receive the Maturity Benefit in lumpsum as specified above and/or in instalments.

Guaranteed Additions-

Provided the policy is in-force, Guaranteed Additions, at the rate of ₹ 50 per thousand Basic Sum Assured for the first five years and ₹ 55/- per thousand Basic Sum Assured from 6th policy year till the end of premium paying term, will be added to the policy at the end of each policy year for which full year’s premiums have been paid. In case the premiums are not duly paid, the Guaranteed Additions shall cease to accrue under a policy.

In case of a paid-up policy or on surrender of a policy the Guaranteed Addition for the policy year in which the last premium is received will be added on proportionate basis in proportion to the premium received for that year.

Inbuilt Critical Illness Benefit-

Benefit-

On first diagnosis of any one of the 15 critical illnesses as mentioned below, provided the policy is in-force on the date of diagnosis by payment of all premiums due under the policy, the following benefits/ facilities shall be available.

(A)- Lumpsum Benefit- Inbuilt Critical Illness Benefit equal to 10% of Basic Sum Assured shall be payable provided the claim is admissible.

(B)- Option to defer the payment of premiums if a claim under Inbuilt Critical Illness Benefit is paid: When a claim under Inbuilt Critical Illness Benefit is admitted, life assured will have an option to defer the payment of premiums falling due within 2 years from the date of admission of Critical Illness claim under the policy (including rider premiums). The deferment of premiums shall be allowed for a period of 2 years from the date of admission of Critical Illness claim and subsequent premiums, if any, shall be payable on their due dates. No interest shall be charged from the life assured for deferred premiums within the period of such deferment. During this period, if any outstanding premium(s) are not paid, and any of the benefits payable under the base policy and/or rider(s) become due, the applicable benefit(s) shall be payable as under an in-force policy after the deduction of all the premiums due under the policy.

(C)- Medical Second Opinion: The policyholder will have facility of taking Medical Second Opinion through the available healthcare providers internationally or through reputed hospitals in India or through specialist doctors available in different places depending on the arrangement in this regard by the Corporation. The Medical Second Opinion shall not include the cost of any diagnostic tests. This facility shall be available only once during the policy term with no extra cost.

The Corporation will not be responsible for the opinion provided by Medical Second Opinion. This provision for all or either of the options of Medical Second Opinion is subject to availability of the facility and arrangements made by the Corporation and as intimated in this regard.

Conditions and restrictions under Inbuilt Critical Illness Benefit-

(A)- Inbuilt Critical Illness benefit will be payable only after the Corporation is satisfied on the basis of available medical evidence that the specified illness has occurred. However, in some illnesses covered under this benefit, a specific deferment period applies to establish permanence of the illness covered.

(B)- The inbuilt Critical Illness Benefit shall be payable only once during the currency of the policy. Under a paid-up policy proportionate benefit amount shall be payable as mentioned below.

(C)- The list and definitions of the 15 Critical Illness conditions covered under this benefit-

1. CANCER OF SPECIFIED SEVERITY

(1)- A malignant tumor characterized by the uncontrolled growth and spread of malignant cells with invasion and destruction of normal tissues. This diagnosis must be supported by histological evidence of malignancy. The term cancer includes leukemia, lymphoma and sarcoma.

(2)- The following are excluded-

- All tumors which are histologically described as carcinoma in situ, benign, pre-malignant, borderline malignant, low malignant potential, neoplasm of unknown behavior, or non-invasive, including but not limited to: Carcinoma in situ of breasts, Cervical dysplasia CIN-1, CIN -2 and CIN-3.

- Any non-melanoma skin carcinoma unless there is evidence of metastases to lymph nodes or beyond

- Malignant melanoma that has not caused invasion beyond the epidermis

- All tumors of the prostate unless histologically classified as having a Gleason score greater than 6 or having progressed to at least clinical TNM classification T2N0M0

- All Thyroid cancers histologically classified as T1N0M0 (TNM Classification) or below;

- Chronic lymphocytic leukemia less than RAI stage 3

- Non-invasive papillary cancer of the bladder histologically described as TaN0M0 or of a lesser classification,

- All Gastro-Intestinal Stromal Tumors histologically classified as T1N0M0 (TNM Classification) or below and with mitotic count of less than or equal to 5/50 HPFs;

- All tumors in the presence of HIV infection.

2. OPEN CHEST CABG-

- The actual undergoing of heart surgery to correct blockage or narrowing in one or more coronary artery(s), by coronary artery bypass grafting done via a sternotomy (cutting through the breast bone) or minimally invasive keyhole coronary artery bypass procedures. The diagnosis must be supported by a coronary angiography and the realization of surgery has to be confirmed by a cardiologist.

- The following are excluded: Angioplasty and/or any other intra-arterial procedures

3. MYOCARDIAL INFARCTION

(First Heart Attack of specific severity)

(I)- The first occurrence of heart attack or myocardial infarction, which means the death of a portion of the heart muscle as a result of inadequate blood supply to the relevant area. The diagnosis for Myocardial Infarction should be evidenced by all of the following criteria:

- A history of typical clinical symptoms consistent with the diagnosis of acute myocardial infarction (For e.g. typical chest pain)

- New characteristic electrocardiogram changes

- Elevation of infarction specific enzymes, Troponins or other specific biochemical markers.

(II)- The following are excluded:

- Other acute Coronary Syndromes

- Any type of angina pectoris

- A rise in cardiac biomarkers or Troponin T or I in absence of overt ischemic heart disease OR following an intraarterial cardiac procedure.

4. KIDNEY FAILURE REQUIRING REGULAR DIALYSIS

End stage renal disease presenting as chronic irreversible failure of both kidneys to function, as a result of which either regular renal dialysis (hemodialysis or peritoneal dialysis) is instituted or renal transplantation is carried out. Diagnosis has to be confirmed by a specialist medical practitioner.

5. MAJOR ORGAN /BONE MARROW TRANSPLANT (as recipient)

(I)- The actual undergoing of a transplant of:

- One of the following human organs: heart, lung, liver, kidney, pancreas, that resulted from irreversible end-stage failure of the relevant organ, or

- Human bone marrow using hematopoietic stem cells. The undergoing of a transplant has to be confirmed by a specialist medical practitioner.

(II)- The following are excluded:

- Other stem-cell transplants

- Where only islets of Langerhans are transplanted

6. STROKE RESULTING IN PERMANENT SYMPTOMS

(I)- Any cerebrovascular incident producing permanent neurological sequelae. This includes infarction of brain tissue, thrombosis in an intracranial vessel, hemorrhage and embolization from an extracranial source. Diagnosis has to be confirmed by a specialist medical practitioner and evidenced by typical clinical symptoms as well as typical findings in CT Scan or MRI of the brain. Evidence of permanent neurological deficit lasting for at least 3 months has to be produced.

(II)- The following are excluded:

- Transient ischemic attacks (TIA)

- Traumatic injury of the brain

- Vascular disease affecting only the eye or optic nerve or vestibular functions.

7. PERMANENT PARALYSIS OF LIMBS

Total and irreversible loss of use of two or more limbs as a result of injury or disease of the brain or spinal cord. A specialist medical practitioner must be of the opinion that the paralysis will be permanent with no hope of recovery and must be present for more than 3 months.

8. MULTIPLE SCLEROSIS WITH PERSISTING SYMPTOMS

(I)- The unequivocal diagnosis of Definite Multiple Sclerosis confirmed and evidenced by all of the following:

- investigations including typical MRI findings which unequivocally confirm the diagnosis to be multiple sclerosis and

- there must be current clinical impairment of motor or sensory function, which must have persisted for a continuous period of at least 6 months.

(II)- Other causes of neurological damage such as SLE and HIV are excluded.

9. AORTIC SURGERY

The actual undergoing of major surgery to repair or correct an aneurysm, narrowing, obstruction or dissection of the aorta through surgical opening of the chest or abdomen. For the purpose of this definition, aorta shall mean the thoracic and abdominal aorta but not its branches.

10. PRIMARY (IDIOPATHIC) PULMONARY HYPERTENSION

(I)- An unequivocal diagnosis of Primary (Idiopathic) Pulmonary Hypertension by a Cardiologist or specialist in respiratory medicine with evidence of right ventricular enlargement and the pulmonary artery pressure above 30 mm of Hg on Cardiac Cauterization. There must be permanent irreversible physical impairment to the degree of at least Class IV of the New York Heart Association Classification of cardiac impairment.

(II)- The NYHA Classification of Cardiac Impairment are as follows:

- Class III: Marked limitation of physical activity. Comfortable at rest, but less than ordinary activity causes symptoms.

- Class IV: Unable to engage in any physical activity without discomfort. Symptoms may be present even at rest.

(III)- Pulmonary hypertension associated with lung disease, chronic hypoventilation, pulmonary thromboembolic disease, drugs and toxins, diseases of the left side of the heart, congenital heart disease and any secondary cause are specifically excluded.

11. ALZHEIMER’S DISEASE/ DEMENTIA

Deterioration or loss of intellectual capacity as confirmed by clinical evaluation and imaging tests, arising from Alzheimer's Disease or irreversible organic disorders, resulting in significant reduction in mental and social functioning requiring the continuous supervision of the Life Assured for a minimum period of 6 months from date of diagnosis. This diagnosis must be supported by the clinical confirmation of an appropriate Registered Medical practitioner who is also a Neurologist and supported by the Corporation’s appointed doctor.

The following are excluded:

- Non-organic disease such as neurosis and psychiatric illnesses; and

- Alcohol-related brain damage.

12. BLINDNESS

(I)- Total, permanent and irreversible loss of all vision in both eyes as a result of illness or accident.

(II)- The Blindness is evidenced by:

- corrected visual acuity being 3/60 or less in both eyes or ;

- the field of vision being less than 10 degrees in both eyes.

(III)-The diagnosis of blindness must be confirmed and must not be correctable by aids or surgical procedure.

13. THIRD DEGREE BURNS

There must be third-degree burns with scarring that cover at least 20% of the body’s surface area. The diagnosis must confirm the total area involved using standardized, clinically accepted, body surface area charts covering 20% of the body surface area.

14. OPEN HEART REPLACEMENT OR REPAIR OF HEART VALVES

The actual undergoing of open-heart valve surgery is to replace or repair one or more heart valves, as a consequence of defects in, abnormalities of, or disease-affected cardiac valve(s). The diagnosis of the valve abnormality must be supported by an echocardiography and the realization of surgery has to be confirmed by a specialist medical practitioner. Catheter based techniques including but not limited to, balloon valvotomy/valvuloplasty are excluded.

15. BENIGN BRAIN TUMOR

(1)- Benign brain tumor is defined as a life threatening, non-cancerous tumor in the brain, cranial nerves or meninges within the skull. The presence of the underlying tumor must be confirmed by imaging studies such as CT scan or MRI.

(2)- This brain tumor must result in at least one of the following and must be confirmed by the relevant medical specialist.

- Permanent Neurological deficit with persisting clinical symptoms for a continuous period of at least 90 consecutive days or

- Undergone surgical resection or radiation therapy to treat the brain tumor.

The following conditions are excluded: Cysts, Granulomas, malformations in the arteries or veins of the brain, hematomas, abscesses, pituitary tumors tumors of skull bones and tumors of the spinal cord.

Waiting Period-

A waiting period of 90 days will apply from the date of commencement of risk or date of revival of risk cover, whichever is later, to the first diagnosis of the Critical Illness under consideration. This would mean that this benefit shall terminate if any of the contingencies mentioned in Condition 3.II. of Part C of this policy document occurs-

- At any time on or after the date on which the risk under the Policy has commenced but before the expiry of 90 days reckoned from that date or

- before the expiry of 90 days from the date of Revival.

However, waiting period will not apply to conditions arising directly out of accident.

Survival Period-

A survival period of 30 days is applicable from the date of diagnosis of Critical Illness listed above. If death occurs within the survival period, no inbuilt critical illness benefit shall be payable.

Exclusions-

The Corporation shall not be liable to pay any of the benefits under Inbuilt Critical Illnesses Benefit if the critical illness has occurred directly or indirectly as a result of any of the following

- Any of the listed critical illness conditions where death occurs within 30 days from the date of diagnosis

- Any sickness condition related to the critical illnesses listed above manifesting itself within 90 days of the commencement of risk or revival of risk cover, whichever is later.

- Intentionally self-inflicted injury or attempted suicide, irrespective of mental condition.

- Alcohol or solvent abuse, or the taking of drugs except under the direction of a registered medical practitioner.

- War, invasion, hostilities (whether war is declared or not), civil war, rebellion, revolution or taking part in a riot or civil commotion.

- Taking part in any act of a criminal nature.

- Any Pre-existing medical condition.

- HIV or AIDS

- Failure to seek medical or follow medical advice (i.e. failure to undergo tests or treatments that a prudent person would normally undergo as recommended by a Medical Practitioner.

- Radioactive contamination due to nuclear accident.

Termination of Inbuilt Critical Illness Benefit-

The Inbuilt Critical Illness Benefit will terminate on the earliest occurrence of any of the following events

(a) The date on which the claim is paid in respect of this benefit; or

(b) The date of expiry of policy term; or

(c) The date on which surrender benefit are settled under the policy; or

(d) On cancellation/termination of the policy for any reason; or

(e) On cancellation/termination of the policy by the Corporation on grounds of misrepresentation, fraud or nondisclosure established in terms of Section 45 of the Insurance Act, 1938, as amended from time to time; or

(f) On diagnosis of a Critical Illness within the waiting period

(g) Any critical illness manifesting itself during the waiting period is not admissible. The first admissible critical illness which is manifested, diagnosed and lodged after waiting period and during the currency of policy, once admitted for, shall preclude any further critical illness and therefore the benefit will terminate.

(h)

- If the insured event requires the surgical procedure to be performed, the procedure must be the usual treatment for the condition and be medically necessary;

- The Critical Illness benefit shall be payable only on confirmation of the diagnosis by a registered Medical Practitioner appointed/approved by the Corporation;

Rider Benefits-

The following 4 rider(s) are available under this policy:

- Accidental Death and Disability Benefit Rider

- New Term Assurance Rider

- Accident Benefit Rider

- New Critical Illness Benefit Rider

However, the eligible Life Assured can opt between either of the LIC’s Accidental Death and Disability Rider or LIC’s Accident Benefit Rider. Therefore, a maximum of three riders can be availed under this policy.

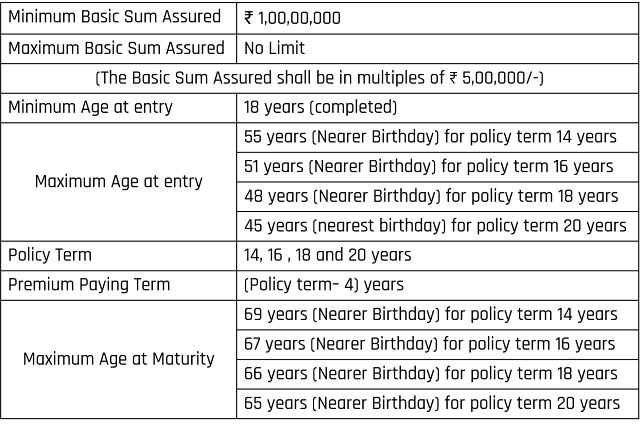

Eligibility Conditions and Other Restriction-

Date of Commencement of Risk under the Plan-

Risk will commence immediately from the date of acceptance of the risk.

Payment of Premiums-

- The policyholder has to pay the Premium on the due dates as specified in the Schedule of this Policy Document along with taxes, if any, as applicable from time to time.

- In case of death of Life Assured under an in-force policy wherein all the premiums due till the date of death have been paid and where the mode of payment of premium is other than yearly, balance premium(s), if any, falling due from the date of death and before the next policy anniversary shall be deducted from the claim amount.

- In case of claim under Inbuilt Critical Illness Benefit is paid and option to defer the payment of premiums is availed, during this deferment period of two years from the date of admission of Inbuilt Critical Illness Benefit claim if any of the benefits payable under the Base Policy and/or rider(s) become due, the applicable benefit(s) shall be payable as under an inforce policy after the deduction of all the premiums due under the policy. If the due premiums are not paid before the expiry of the deferment period of two years from the date of admission of Inbuilt Critical Illness Benefit claim, the Policy lapses.

The Corporation does not have any obligation to issue a notice that premium is due or for the amount that is due.

Grace period-

A grace period of 30 days shall be allowed for payment of yearly or half-yearly or quarterly premiums and 15 days for monthly premiums from date of First unpaid premium. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

If the death of the Life Assured occurs within the grace period but before the payment of the premium then due, the policy will still be valid and the benefits shall be paid after deductions of the said unpaid premium as also the balance premium(s), if any, falling due from the date of death and before the next policy anniversary.

The above grace period will also apply to rider premiums which are payable along with premium for Base Policy.

If an Inbuilt Critical Benefit claim is intimated within the grace period but before the payment of the premium then due, the policy will still be valid and the benefits shall be paid after deductions of the said unpaid premium.

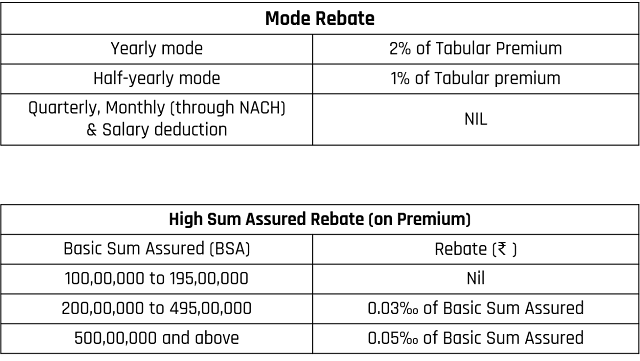

Rebates-

Revival-

An Insurance Policy would lapse on non-payment of due premium within the days of grace. A policy in lapsed condition may be revived during the life time of the Life Assured, but within the Revival Period and before the Date of Maturity, as the case may be. The revival shall be effected on payment of all the arrears of premium together with interest (compounding half yearly) at such rate as fixed by the Corporation from time to time and on satisfaction of Continued Insurability of the Life Assured on the basis of information, documents and reports that are already available and any additional information in this regard if and as may be required in accordance with the Underwriting Policy of the Corporation at the time of revival, being furnished by the Policyholder/Life Assured/Proposer.

The Corporation however, reserves the right to accept at original terms, accept with modified terms or decline the revival of a discontinued policy. The revival of the discontinued policy shall take effect only after the same is approved, accepted and revival receipt is issued by the Corporation.

If the revival period falls beyond the premium paying term and the policy is revived after the due date of survival benefit, then the difference between full Survival Benefit payable under in-force policy and Survival Benefit already paid considering paidup policy shall be paid to the policyholder.

Revival of Rider(s), if opted for, will only be considered along with the revival of the Base Policy and not in isolation.

Policy Loan-

Loan can be availed under this policy provided atleast one full year’s premium has been paid and on completion of one policy year subject to the following terms and conditions, within the surrender value of the policy for such amounts and on such further terms and conditions as the Corporation may fix from time to time.

(A)- The Policy shall be assigned absolutely to and held by the Corporation as security for the repayment of Loan and of the interest thereon.

(B)-The maximum loan as a percentage of surrender value shall be as under:

- For in-force policies – up to 90%

- For paid-up policies – up to 80%

(C)- Interest on Loan shall be paid on compounding half-yearly basis to the Corporation at the rate to be specified by the Corporation at the time of taking loan under this policy. The applicable interest rate shall be based on the method approved by IRDAI. The first payment of interest is to be made on the next Policy anniversary or on the date six months before the next Policy anniversary whichever immediately follows the date on which the Loan is sanctioned and every half year thereafter.

(D)- In the event of default in payment of loan interest on the due dates as herein mentioned above and when the outstanding loan amount along with interest is to exceed the surrender value, the Corporation would be entitled to foreclose such policies. Such policies when being foreclosed shall be entitled to payment of the difference of surrender value and the outstanding loan amount along with interest, if any.

(E)- Corporation is entitled to recover or recall the amount of the Loan with all due interest by giving 3 months’ notice In case the policy shall mature or become due for survival benefits or surrendered or becomes a claim by death, the Corporation shall become entitled to deduct the amount of outstanding Loan, together with all interest from the policy moneys.

No comments:

Post a Comment